Facts About U S. Deaths from Excessive Alcohol Use Alcohol Use

Age-standardized alcohol-attributable death rates among females increased from 22.7 per 100,000 population during 2016–2017 to 23.6 during 2018–2019, and to 29.4 during 2020–2021. Death rates among females were highest from heart disease and stroke during each period. Among both males and females, alcohol-attributable death rates increased for most cause of death categories.

Data Sources and Measures

The average number of sex-specific alcohol-attributable deaths increased among all age groups from 2016–2017 to 2020–2021(Figure). The average annual number of deaths from excessive alcohol use among males increased by 25,244 (26.8%), from 94,362 deaths during 2016–2017 to 119,606 during 2020–2021 (Table 2). Age-standardized death rates among males increased from 54.8 per 100,000 population during 2016–2017 to 55.9 during 2018–2019, and to 66.9 during 2020–2021. During each period, among all excessive alcohol use cause of death categories, death rates among males were highest from 100% alcohol-attributable chronic conditions.

- If drinking alcohol is taking a toll on your mental health, let your doctor know or talk to a licensed mental health specialist such as a counselor or therapist.

- Most studies found that alcohol-related mortality—including DUI fatalities,23,25,39,46 combined alcohol- and other drug-related mortality,68,70 deaths of despair,73 cirrhosis/liver disease mortality,53,57 and other chronic alcohol mortality65—was higher in rural counties.

- Alcohol availability and alcohol control policies, along with health care availability, also are germane for deaths attributable to alcohol misuse or AUD.

- The rate of such deaths had been increasing in the two decades before the pandemic, by 7% or less each year.

- If a person tries to quit drinking on their own during end-stage alcoholism, they may experience severe symptoms of withdrawal, including tremors and hallucinations.

It’s also a risk to others through drunken driving or alcohol-fueled violence. Surveys suggest that more than half the alcohol sold in the U.S. https://www.flirtybor.com/ph-actors-and-actresses-arrested-for-drug-and-alcohol-abuse.html is consumed during binge drinking episodes. NEW YORK — The rate of deaths that can be directly attributed to alcohol rose nearly 30% in the U.S. during the first year of the COVID-19 pandemic, according to new government data. Stigma, discrimination and misconceptions about the efficacy of treatment contribute to these critical gaps in treatment provision, as well as the continued low prioritization of substance use disorders by health and development agencies.

Health risks of alcohol use

Other policy changes, like permitting alcohol to be carried in to-go cups, posed “a risk factor for excessive alcohol use,” Esser said. If you drink heavily or notice signs of liver damage or other health issues that may be related to drinking too much alcohol, talk to your doctor about it. If necessary, they can refer you to a rehabilitation center to get the drinking under control. Alcohol can increase your risk for high blood pressure, which can https://zlatschool34.ru/en/about-good-deeds-and-virtues/ put you at risk for a heart attack or a stroke. And while alcohol is a liquid, it can still pack on empty calories, and drinking too much may lead to obesity.

Alcohol deaths have more than doubled in recent years, especially among women

Most studies found that alcohol-related mortality—including DUI fatalities,23,25,39,46 combined alcohol- and other drug-related mortality,68,70 deaths of despair,73 cirrhosis/liver disease mortality,53,57 and other chronic alcohol mortality65—was higher in rural counties. In contrast, three studies using mortality data from 2010 onward found that mortality from multiple causes72,86 and cirrhosis/liver disease mortality55 were higher in urban areas. Four studies found a nonsignificant relationship between urbanicity/metropolitan status and DUI fatalities40,47 and deaths of despair.72,75 The heterogeneity in these results suggests there may be important effect modifiers for further consideration. Rises in alcohol deaths may be attributed to a variety of factors including, in part, increases in drinking and low treatment rates.

According to the CDC, more than one million people die yearly of cirrhosis, including over 40,000 people in the United States. Since her death, tributes have flooded in for the successful lawyer, who had been working at global law firm Squire Patton Boggs. Her work involved general commercial matters as well as contentious and non-contentious issues relating to intellectual property law. Methanol is a deadly chemical that can be found in home-brewed or counterfeit alcohol, and only a small amount can cause organ http://www.all-news.net/notes/1146499 failure, blindness and death. Simone had not noticed anything out of the ordinary with the drinks, but she and her friends woke up with headaches and their condition grew worse over the following day.

Cardiovascular Health

Accordingly, there is an opportunity for future research to explore associations at smaller scales, such as census tracts or neighborhoods, to inform more targeted interventions and local policy solutions. Even before the pandemic, U.S. alcohol consumption was trending up, and Americans were drinking more than when Prohibition was enacted. But deaths may have increased since the COVID-19 pandemic began for several reasons, including people with alcohol-related illnesses may have had more trouble getting medical care, Esser said. Barriers to alcohol use disorder treatment include a combination of provider, patient, financial, and infrastructure factors. Providers often lack confidence or knowledge in treating alcohol use disorder and are uncomfortable with medication and other treatment options, which may decrease the likelihood that they will manage treatment or make referrals. To address this, recent initiatives are enhancing education for both practicing and training providers through mandatory training programs and curriculum enhancements in medical schools.

Implications for Public Health Practice

Deaths caused by diseases known to be a direct consequence of alcohol, by age, sex, and region. Based on the findings from the study, the researchers call for “tailored interventions” to help curb alcohol-related deaths. “Because women have less alcohol dehydrogenase (ADH) activity – an enzyme in the stomach and liver that helps break down alcohol – women are more vulnerable to the effects of alcohol on the liver, heart and brain,” the doctor said.

- Federal data show that 1 in 10 people had an alcohol use disorder in the past year, over 4 in 10 alcohol users report binge drinking in the past month, and per capita alcohol consumption is higher than the decade prior.

- Deaths from causes fully attributable to alcohol use have increased during the past 2 decades in the United States, particularly from 2019 to 2020, concurrent with the onset of the COVID-19 pandemic.

- While several factors led to this dramatic increase, “the main one was most likely the COVID-19 pandemic,” said Dr. Michael Siegel, a professor of public health and community medicine at Tufts University.

- “There may be bias in analyzing this mix of population in a non-prospective randomized fashion, which is the gold standard for scientific research but not possible for analyzing this data,” he went on.

- Cross-sectional designs using multiple years of data focused on population associations (e.g., economic disadvantage with mortality).

Other data mirror this trend – emergency department (ED) visits for SUD are on the rise and account for twice the number of ED visits compared to opioids. Alcohol related ED visits account for nearly half of all SUD related visits (45%), far higher than the next highest group, opioids, accounting for 13% of ED visits. It’s a life-threatening, late-stage liver disease that can stop the liver from properly filtering blood. This can cause other organs in your body to shut down and increase your risk for death.

LimeFX Review 2024: Read Before You Trade

Traders conduct all financial transactions from the secure back office, and LimeFX does not charge deposit or withdrawal fees. Third-party costs may apply, and I recommend traders check with their preferred provider. I like that LimeFX offers several cryptocurrencies, but I am missing more third-party payment processors and localized options, especially for its core markets. LimeFX has competitive spreads in some instruments such as EUR/USD and impressive research written by in-house analysts. Moreover, LimeFX is a crypto-friendly broker – traders can choose from 34 CFDs on cryptocurrencies and make deposits and withdrawals in crypto.

LimeFX Opening an Account

In my tests, I limefx official site received speedy responses—the same day for email and a wait of just a few seconds for live chat. Despite the lack of phone support, I rate LimeFX as average in this category. Popular features such as 1-click trading, alerts, and watchlists are available.

Are Fees at LimeFX Competitive?

- To read the fine print, traders can find the Customer Agreement in the footer of the website.

- LimeFX offers bank wires, credit/debit cards, and several cryptocurrencies as withdrawal methods.

- These strategies suit diverse trading needs, styles or preferences and can guide you in strategy planning.

- LimeFX offers a swap-free Islamic account that adheres to the principles of Sharia law.

Yes, negative balance protection is offered, ensuring customers do not lose more than their account balance under adverse market circumstances. The interest rate tracker allows you to monitor changes in central bank rates, which influence currency values and market trends. LimeFX boasts a broad spectrum of well-organized and highly beneficial analytical and research resources.

Swap-free accounts are available for overnight positions, and Sharia-compliant accounts are available for halal trading. LimeFX boasts a proprietary platform with an intuitive UI and tailored features called LimeFXTrader. It’s a sidebar news feed embedded into the application that provides traders with up-to-date personalized market information. LimeFX was founded in 2011 and offers a range of trading platforms and tools. While it is MiFID regulated, it is not publicly traded and lacks some major regulatory authorizations.

Opening an LimeFX Account

The breakdown across the two different types of accounts is laid out in a limefx official site reassuringly transparent manner. LimeFX is a global broker, who offers a new take on certain aspects of the retail brokerage space. Founded in 2011, its products are available through LimeFX.com and LimeFX.eu. LimeFX does not levy internal withdrawal fees, but traders should consider potential third-party payment processor charges.

That being said, there isn’t much educational content for learning how to trade or understand market dynamics. It’s worth mentioning that the broker does have a blog and a YouTube channel, yet I was still left wanting more. Opening an account with LimeFX is done online with a few simple steps which enable you to set up a real or demo account. The process also gives you plenty of information about trading in forex markets. LimeFX has made significant progress in a relatively short period of time. Since entering a very competitive market eight years ago, it has built up a client base of almost one million traders and won a host of industry awards.

Content is updated frequently and is accessible to all levels of traders. A broad range of topics from technical analysis to trading strategies and platform tutorials are covered. With a perfect score in this category, LimeFX has gone above and beyond to educate its clients. LimeFX is known for offering a smooth trading experience with user-friendly platforms and valuable market analysis .They also cater to a variety of traders with different account options.

Their platform is designed for efficiency, and I can always rely on their consistent and reliable market analysis to guide my trading strategies. Their user-friendly platform and thorough market analysis have made navigating the financial markets effortless. LimeFX seems to be hitting all the high marks for you – reliable service, user-friendly platform, and top-notch market analysis. Their platform is user-friendly and their market insights are invaluable. Traders can expect narrow spreads and a straightforward fee structure, so you know exactly what you pay for each transaction. LimeFX also has modest minimum deposits, which is perfect for inexperienced traders.

OCC prepares for spot Bitcoin ETF Options Heres what’s next

.jpeg)

High management fees, like the one charged by Grayscale (1.50%), can cut into your ETF profits. Investors should aim for funds with annual management fees between 0.2% and 0.5%. BlackRock, Fidelity and others updated their paperwork earlier this week to announce fees less than 0.5 per cent, with several promising to waive charges altogether in the early months of trading. Dennis Kelleher, president of Better Markets, said the approval “is a historic mistake that will not only unleash crypto predators on tens of millions of investors and retirees but will also likely undermine financial stability”. But consumer protection and investor groups have warned that making the product available via an ETF would encourage retail investors to move money into a sector known for repeated scandals and massive price fluctuations.

FBTC vs. Other Bitcoin Investments

Futures are complex derivatives instruments that should only be traded by experienced investors. Bitcoin ETFs are publicly traded investment funds that enable investors to gain exposure to bitcoin (BTC) without actually owning the cryptocurrency. Unlike cryptocurrencies that are traded on crypto exchanges, ETFs are traded on traditional securities exchanges, such as the New York Stock Exchange and Nasdaq.

Spot bitcoin ETFs vs. buying bitcoin: What’s the difference?

Nearly all cryptocurrency ETFs contract exchanges or other enterprise-level custodians to hold their crypto in cold storage. These custodians also hold criminal insurance, which covers the ETF’s holdings and, thus, value for investors. In October 2024, the SEC approved the Cboe exchange to allow traders to trade spot Bitcoin ETF options on the Fidelity Wise Origin Bitcoin Fund (FBTC) and the ARK 21Shares Bitcoin ETF (ARKB). The Commission also approved the New York Stock Exchange to allow options trading on the Grayscale Bitcoin Trust (GBTC), the Grayscale Bitcoin Mini Trust (BTC), and the Bitwise Bitcoin ETF (BITB).

While other bitcoin ETFs, like those based on futures contracts, have their place, FBTC’s spot structure makes it an attractive choice for investors looking for direct exposure to bitcoin’s price performance. Additionally, crypto-focused stocks offer indirect exposure but often include broader company risks, making FBTC a more focused option. FBTC is unique compared to most other spot bitcoin ETFs in that the manager of the fund, Fidelity, is also the custodian of the underlying physical asset. A spot bitcoin ETF allows investors to gain direct exposure to bitcoin without holding it.

Our estimates are based on past market performance, and past performance is not a guarantee of future performance. In exchange for an annual fund management fee, the financial institution manages the purchasing, storing, and safekeeping of bitcoin on behalf the changing nature of news social media and journalism around the world of the ETF’s investors. FBTC is designed to track bitcoin’s price closely, reflecting its performance with minimal deviation.

If a retirement investor would like to get a modest amount of exposure to bitcoin without opening an account at a crypto exchange or a bitcoin IRA, owning shares of getting started with blockchain a bitcoin ETF is a reasonable alternative. While almost anyone can open a Coinbase account, not everyone is comfortable doing so. Others may be restricted to buying and selling securities in their traditional brokerage accounts for various reasons. That meant it lacked the highly liquid, smooth redemption mechanism that ETFs enjoy. And as a result, shares often traded at a big premium or discount to the actual value of the underlying bitcoin. Investors are understandably reluctant to pay, say, $1 for 90 cents worth of assets.

- Although FBTC is designed to offer daily liquidity, rapid price movements in the bitcoin market could affect the ETF’s ability to trade at its intended value.

- Jeff Reeves writes about investments, the stock market, exchange-traded funds and retirement topics.

- Spot BTC ETF options are traded on traditional financial exchanges such as the NYSE, offering a familiar and regulated environment for traders transitioning from equities to crypto.

- BTC is the ticker symbol for bitcoin, and it’s how the cryptocurrency is abbreviated and represented in the financial markets.

- Bitcoin’s price volatility means the value of the ETF can fluctuate significantly, so staying informed about market conditions and any relevant news is crucial.

Challenges In Spot Bitcoin ETF Approvals

.jpeg)

Bitcoin ETFs function in a way similar to the traditional exchange-traded funds you might be familiar with. An ETF issuer, typically an asset management company, purchases the underlying asset and securely stores it with a custodian. Then, it issues shares to its fund to provide investors with access to the underlying asset held in the fund. Bitcoin ETFs have been a topic of discussion in the crypto markets since the Winklevoss twins first tried to list one back in 2013. Spot bitcoin ETFs were finally approved on Jan. 10, 2024, and began trading the next day.

Summary: Best Bitcoin ETFs

Most spot Bitcoin ETFs rely on a third-party custodian to actually store the Bitcoin they hold — much like how spot gold ETFs often keep their physical gold holdings in the vault of a third-party custodian. Fees reduced basic data analysis big data for epidemiology to 0.12% until Jan. 11, 2025 or the first $5 billion in fund assets, whichever comes first. Your investment style can dictate which kind of fund is best for your portfolio. Now that you’re familiar with both derivatives, let’s look at what makes BTC options different from their spot BTC ETF options counterpart.

For example, if you believe the ETF price will rise, you can purchase a call option. Conversely, a put option allows you to make gains if the ETF price declines. These contracts are then settled in cash or shares, making them an attractive option for traders seeking a regulated environment. The ETF then issues shares corresponding to the number of Bitcoins it holds. These shares are available on traditional stock or exchanges, and prices generally reflect the currency’s prevailing market price.

Volatility Of Bitcoin Prices

In January, the SEC formally approved exchange-traded funds linked directly to bitcoin. So-called “spot” bitcoin ETFs can hold the digital asset without equivocation or complications. There were already crypto-related ETFs and trusts out there, but there had never been a spot Bitcoin ETF on the market before the Jan. 2024 approval. These recently approved ETFs are the first cryptocurrency funds to trade on a major exchange and hold Bitcoin directly.

A key difference between FBTC and other spot bitcoin ETFs is that the bitcoin backing FBTC is held in self-custody by Fidelity Digital Assets. Fidelity’s reputation as a leading asset manager provides confidence for investors looking to enter the bitcoin market through a regulated and well-established financial institution. Beginner option traders can start with Spot BTC ETF options for their relative stability, while BTC options require advanced knowledge of market volatility and risk management.

As for Bitcoin options, they provide a more direct connection to BTC itself. Unlike spot BTC ETF options, Bitcoin options on OKX are only settled in Bitcoin instead of stablecoins. Each contract represents the right to buy or sell shares of the ETF at a specific price.

Understanding these risks is vital for developing sound trading strategies and managing exposure effectively. Although this might seem overly optimistic, it reflects the speculative nature of options trading and the market’s excitement around Bitcoin’s potential. Such activity not only highlights trader sentiment but also underscores how spot BTC ETF options can serve as a barometer for Bitcoin’s long-term outlook. Investors should understand the risk of investing in a spot bitcoin ETF before allocating any funds toward one. Considering the hoops you have to jump through to own bitcoin—exchange accounts, digital wallets, private keys, network transfers, etc.—a spot bitcoin ETF is one of the easiest ways to add bitcoin exposure to your portfolio. Security is always a concern for cryptocurrencies, even when they are held by investment firms.

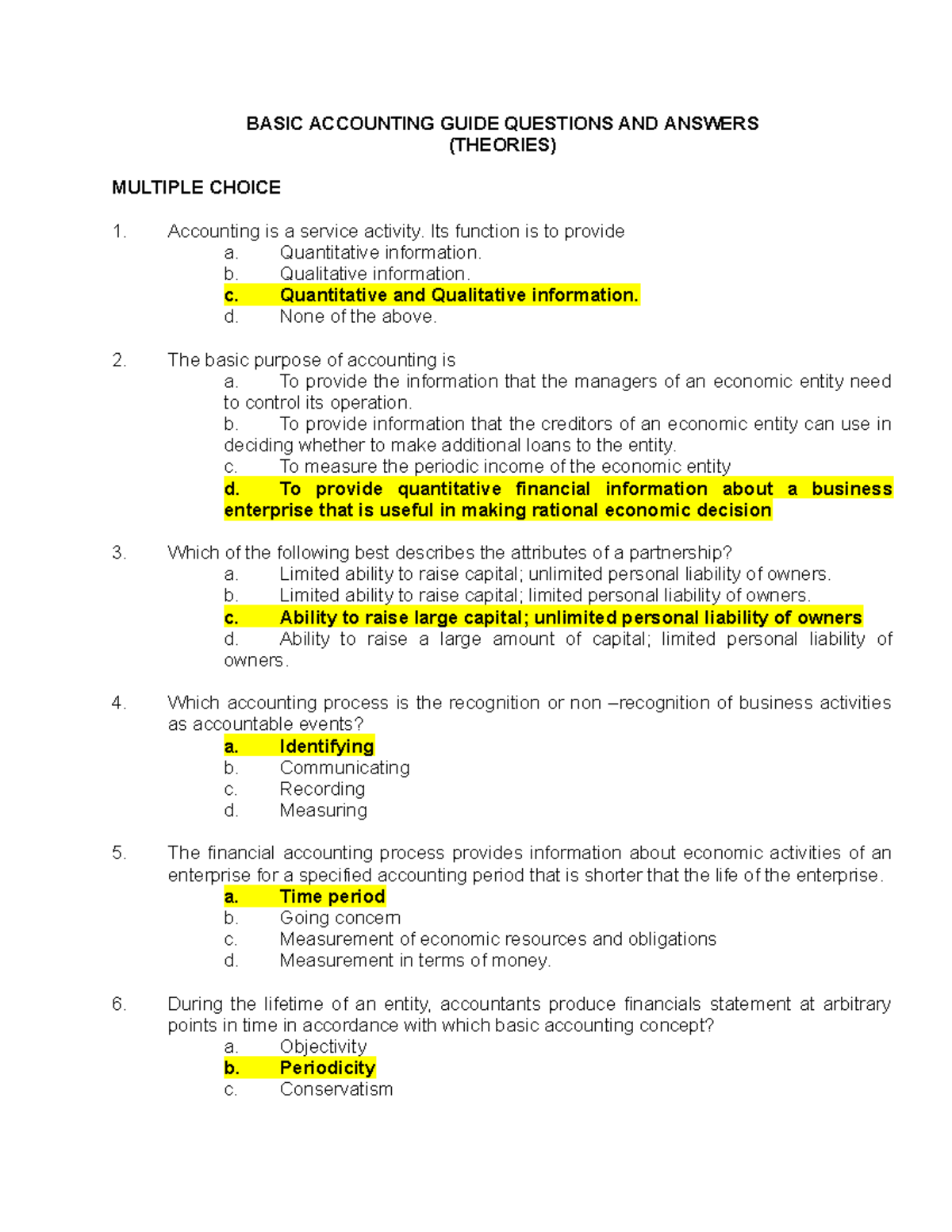

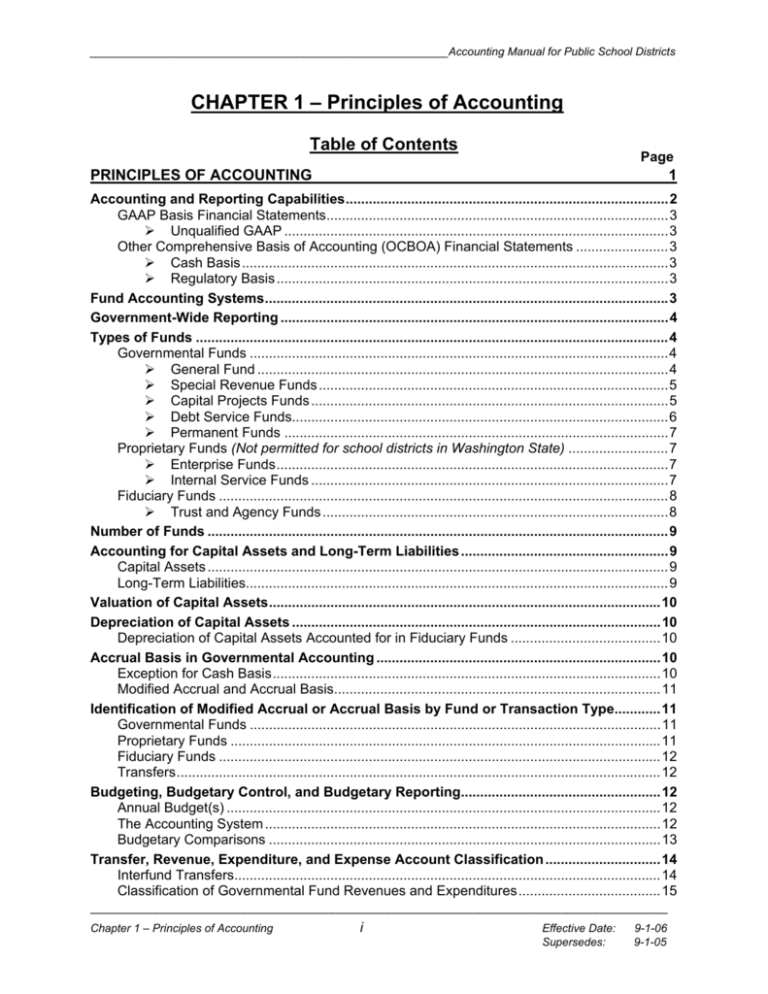

Accounting Principles Practice Test Can You Pass It?

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Use AI to generate personalized quizzes and flashcards to suit your learning preferences. Ace your exams with our all-in-one platform for creating and sharing quizzes and tests.

____________ accounting requires you to take note of both cash collected and as well as accounts receivable.

There’s no need to feel confused about these basic accounting principles or stressed out because you feel like there’s never enough time to finish all the questions on your accounting quizzes and tests. My students efficiently solve accounting problems with confidence in the allotted time. And I can show you how to do this too with Pass Accounting Class Resources.

Accounting Concepts and Principles

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Common accounting decision-making models include the rational decision model, the incremental decision model, and the satisficing decision model. Each of these models has its own set of steps that should be followed when deciding. After you have answered all 20 questions, click “Grade This Quick Test” at the bottom of the page to view your grade and receive feedback on your answers.

Where should we send your answer?

CFI is the official global provider of the Financial Modeling and Valuation Analyst (FMVA)™ certification program, designed to transform anyone into a world-class financial analyst. Enroll now to gain the skills you need to take your career to the next level. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Preparation is the key to success when trying to pass your accounting class.

- This quiz covers essential concepts necessary for understanding accounting fundamentals.

- Common accounting decision-making models include the rational decision model, the incremental decision model, and the satisficing decision model.

- Perfect for students looking to solidify their understanding of accounting basics.

- Test your knowledge of fundamental accounting principles, including the dual aspect concept and the impact of transactions on various account types.

- He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. So, how did you score on the accounting principles practice test above? More importantly, did you really know the answers, or did you have to guess at some of the questions? Ideally, you should be able to answer those accounting questions with ease. When making decisions in accounting, it is essential to consider all relevant factors. Some of the factors that may be considered include the company’s financial position, Cash Flow, profitability, and business strategy.

Share with classmates or export to Excel and your learning management system. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Ask a question about your financial situation providing as much detail as possible.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Try out these quiz questions and answers and check your financial knowledge. Accounting principles are the common rules and guidelines that companies need to follow while preparing and presenting financial statements.

If you need a refresher course on this topic you can view our basic accounting concepts tutorial here. Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.

In accounting, decision-making is the process of choosing between two or more courses of action to achieve the desired outcome. Factors that should be considered when making decisions include the company’s financial position, Cash Flow, profitability, and business strategy. Accountants use the information to make decisions by analyzing data and trends to make informed decisions to help the company achieve how nonqualified deferred compensation nqdc plans work its goals. Test your knowledge with this multiple choice question (MCQ) test on accounting principles and concepts. If you’re unsure about any questions, you can read about this topic in detail in the explanation section. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Alcohol and Epilepsy: A Potential Seizure Trigger

Most of these antiepileptic medications also have side effects that mimic those of alcohol. They may slow down central nervous system responses, make a person sleepy, or cause parts of the brain to work differently. If you research a medication and these symptoms show up, it’s likely that AED will lower your tolerance for alcohol, too.

Awareness or consciousness return slowly after the alcohol withdrawal seizure ends. The person may appear confused, sleepy, irritable, embarrassed, or frightened afterwards. If you take an ASM, speak with your doctor about the risks of drinking alcohol.

For people with epilepsy, alcohol may interfere with anti-seizure medications and increase the risk of seizures. People who drink a lot of alcohol for an extended period can develop permanent changes in their brains, and removing alcohol can lead to withdrawal symptoms. Seizures, and a severe condition called delirium tremens, are possible complications of alcohol withdrawal. Heavy, long-term alcohol use and withdrawal from alcohol can lead to seizures. Alcohol can also trigger seizures if you have epilepsy and often interacts poorly with anti-seizure medications. There seems to be no increased risk for epilepsy in persons who drink less than 50 grams (about two drinks) of alcohol daily.

Epilepsy and alcohol – is it ever safe?

Consuming alcohol is a common seizure trigger for people with epilepsy. People who chronically consume large amounts of alcohol seem to be more likely to have epilepsy than people who don’t. The CMA suggests patients with alcohol dependence, including alcohol withdrawal seizures, should not be allowed to drive any type of motor vehicle. If a patient wishes to regain their licence, s/he must complete a recognized rehabilitation program for substance dependence and remain sober and and seizure free for 12 months. Binge drinking is defined as a pattern of drinking that brings blood alcohol concentration to 0.08 percent or higher.

Alcohol can also trigger seizures by changing your blood levels of AEDs and other medications. Finally, alcohol can also negatively affect your sleep, contributing to potential seizures. Chronic alcohol abuse is linked to an increased risk of epilepsy (seizure disorder). The sooner you seek professional treatment and get sober, the better your chances of avoiding these serious health complications. The severity of alcohol withdrawal symptoms depends on the severity of the alcohol use disorder.

Alcohol withdrawal syndrome is a condition that occurs after an abrupt stopping of heavy drinking in people with alcohol use disorders (AUD). Limiting or eliminating caffeine or nicotine intake can decrease your risk of seizures if those are triggers for you. Other drugs that trigger seizures, including recreational and illicit substances, should be avoided. In one small study from 2018, people with epilepsy who reported seizures after drinking had consumed seven or more standard-sized drinks before their seizures occurred. Nearly all of the seizures occurred within 12 hours after they stopped drinking. Furthermore, seizures seemed particularly likely if the participants did not regularly drink that much alcohol.

Alcohol and risk of SUDEP in a person with epilepsy

In almost all can you drink alcohol if you have seizures cases, seizures occurred within 12 hours of stopping alcohol consumption. People with a history of alcohol misuse seem to have a greater risk of developing sudden unexpected death in epilepsy (SUDEP) than people with epilepsy with no history. Alcohol withdrawal can be dangerous for many reasons, but seizures and the possible development of delirium tremens increase the risk of severe complications or even death. Getting a good night’s rest is important for proper brain function in all people and especially for those living with epilepsy. Like taking your medication, getting the proper amount of sleep at the right time is important for controlling seizures. Some medications, including over-the-counter options, can change how the body processes your AEDs, leading to seizures.

Also, if there are 3 or more seizures in a row and the person does not regain consciousness in between seizures, they should be evaluated in a hospital emergency room. Experiencing this kind of seizure can make you hurt yourself by biting your tongue or hitting your head. BetterHelp offers affordable mental health care via phone, video, or live-chat.

- If you experience an alcohol-related seizure, seek immediate medical attention.

- Awareness or consciousness return slowly after the alcohol withdrawal seizure ends.

- The risk in people with epilepsy is roughly 1 in 1,000 people per year.

- Alcohol may negatively affect sleep, and sleep disruptions may trigger seizures.

- Your doctor may use a test called an electroencephalogram (also called an EEG) to make the determination.

About 5 percent of people detoxing from alcohol abuse will have alcohol withdrawal seizures as part of the process of quitting drinking. This can happen whether or not a person has epilepsy at the time of the withdrawal. However, people with epilepsy may be more likely to have seizures while going through alcohol withdrawal. Heavy alcohol use can lead to seizures, especially when you stop drinking and start to enter a period of withdrawal.

Dangers of an Alcohol Withdrawal Seizure

Alcohol withdrawal seizures typically develop 6-48 hours after you stop drinking, but they can occur 2-7 days after your last drink. The seizures can develop abruptly without warning, and multiple seizures can occur within a 6- to 8-hour period. When alcohol withdrawal syndrome sets in, seizures may arise within approximately 6 to 48 hours.

Factors in Choosing Epilepsy Treatments for Your Child

Always check with your health care provider or pharmacist to see if any of your medication or supplements interact with your epilepsy medication. If drinking alcohol worsens your seizures, you should avoid alcohol completely. Excessive alcohol use can lead to abnormal electrical activity in the brain, worsen seizures and disrupt sleep, which may also trigger a seizure. This is a serious complication of the alcohol withdrawal syndrome and needs to be treated in a hospital emergency room. Perhaps the biggest risk with alcohol and seizures is binge drinking.

What is Equity in Forex Trading?

Enhance your returns by trading your preferred assets with minimal spreads, low commissions, and precise execution. With friendly Customer Support, the latest technology and a range of account types, we’ve got everything you need to discover better trading. If he decides to stop his deal after making a $35 profit, his new balance will be $235. Understand key terminology with examples and learn how to make your first successful trade. It represents the actual value of the account at any given moment and is a crucial metric for storage security specialist jobs assessing account health and profitability. Naturally, the broker may stop it themselves if there is leverage or any other resource being used.

A margin call refers to the situation when the margin in an account is depleted and requires either to be funded further by the trader or the position to be closed. The best way to avoid negative equity is to always have stop-loss orders. This will basically tell the system that once losses reach a certain amount, the trade needs to be closed.

What is equity in forex?

This can indicate that the trader is taking on too much risk and may need to adjust their trading strategy. Equity forex represents the true value of a trader’s account and is a crucial metric for assessing their overall performance. Account equity shows the temporary current value of a trading account given present market exchange rates.

How to Protect Your Equity in Forex Trading

- When your open positions lose money and your equity decreases, you become under psychological risks.

- Balance refers to the total money in a trading account, while equity is the total value of the account, including floating profits or losses.

- But, fundamental data, market news, and even social media posts have been proven to have effects on the financial markets.

- 91.13% of retail investor accounts lose money when trading Online Forex/CFDs with this provider.

- Diversification is the strategy of investing in different assets to reduce the risks of volatility of one asset.

- Choosing the right type of online trading account is an important step in creating your ideal trading environment.Whether you’re new to trading, h…

Any resulting profits or losses are then viewed as realized and are displayed in the trading account’s balance. Equity in Forex how bond yields affect currency movements meaning is almost the same as the cash amount you’d be left with if you sold off all open trading positions at the current market exchange rates. Such unrealized profits or losses are occasionally termed floating profits or losses.

Evaluating Trading Performance

The account equity symbolizes the existing temporary worth of a trading account based on the prevailing market foreign exchange rates. A margin is a deposit required to open and to maintain open positions in the Forex currency market. A margin doesn’t represent a fee or a transaction cost; it’s merely a portion of your account balance set aside and allocated as a deposit to initiate the trade. You calculate this by adding the account balance and the floating profit or loss from open trades. Equity is calculated by adding the account balance to the floating tron price today trx live marketcap chart and info profit or loss from open positions.

The emotional impact of trading can cause traders to make impulsive decisions that have a negative effect on equity. Fear leads to hesitation, causing traders to miss out on potential profits while greed can lead to overtrading and careless risk-taking. Hope, on the other hand, can cause traders to hold onto losing positions for too long, hoping that the market will eventually turn in their favour. Diversification is another important factor to consider when it comes to equity and trading strategies.

In forex trading, equity refers to a trader’s trading balance plus or minus his profit or loss on an open position. If your trading account has unrealized gains, then your equity is the sum of your cash balance and those unrealized gains. Conversely, if you have unrealized losses, your equity is your cash balance subtracted by those losses. Unrealized gains and losses arise from positions whose value has shifted but has not yet been sold off. Once the position is closed, these unrealized gains and losses become realized.